Budget 2021 what you need to know

Simplicity is the ultimate sophistication? This was certainly true for Minister Mboweni’s 2021 Budget speech. The Minister’s enormous task is not a new one as he took to the podium, this time without his beloved Aloe Ferox. Narrowing the deficit and avoiding a sovereign debt crisis were the highlights, as Mboweni delivered a “real” budget without the usual Fynbos analogy.

Simplicity is the ultimate sophistication? This was certainly true for Minister Mboweni’s 2021 Budget speech. The Minister’s enormous task is not a new one as he took to the podium, this time without his beloved Aloe Ferox. Narrowing the deficit and avoiding a sovereign debt crisis were the highlights, as Mboweni delivered a “real” budget without the usual Fynbos analogy.

Priorities for Budget 2021:

- Covid-19 Vaccination Program: A successful vaccine rollout is key to growth

- Economic recovery: Government will support the economic recovery by extending short-term economic support and undertaking reforms to lower the cost of doing business

- Economic Growth: capital expenditure is the fastest growing budget item in a move towards an investment led economy over the long term

- Debt: converting shorter term debt into longer term debt through creation of government bonds and reduce the budget deficit.

- Eskom: Stabilising electricity supply to support industries in the private sector

Favourite comment

“Hope is being able to see light, despite all of the darkness. He observed that sometimes we forget that just beyond the clouds, the sun is shining.”

- A quote inspired by Archbishop Desmond Tutu

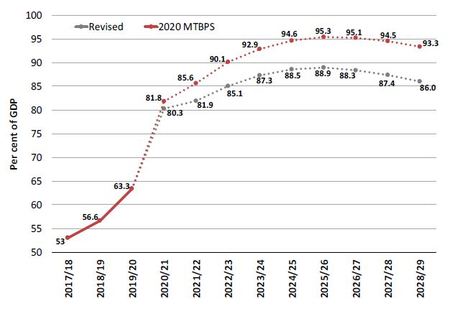

Gross Debt-to-GDP Outlook

Credit: National Treasury

Highlights

• Government will not raise any additional tax revenue from direct tax

• Personal income tax brackets will increase by 5%

• Corporate income tax will be reduced in the medium term

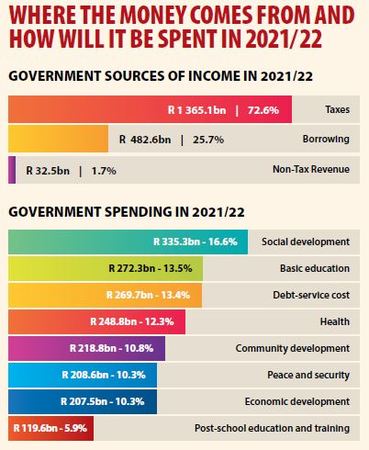

• Expected revenue of R1.36 trillion (27% of GDP) versus R2.05 trillion expenditure (41% of GDP).

• Real GDP to growth estimated at -7.2% in 2020, 3.3% in 2021 and 1.6% in 2022

• Gross debt has increased from 65.6 per cent to 80.3 per cent of GDP for the year 2020/21.

• The proposed fiscal framework will stabilise debt at 88.9 per cent of GDP in 2025/26.

• Government has set aside R9bn for SA’s vaccine roll-out

• The public wage bill reduction is on track to hit nearly R150bn in the medium term

• Major changes to Exchange Control proposed last year are still on the cards for 2021, although no clarity has been provided.

• Excise duties on alcohol and tobacco will increase by 8% to discourage consumption and promote good health

• Increase in fuel levy by 26c per litre

• VAT remains unchanged at 15%

Credit: National Treasury

Financial Emigration – we’re still waiting for news

We were keenly anticipating the release of details surrounding the new capital flow management system announced in the 2020 budget. As soon as we have any official announcement, we will let you know.

Risks to the fiscal and economic outlook

- Downgrades: heading further into sub-investment status with rating agencies could further damage the economy growth

- SOE’s: Frivolous expenditure and poor financial management of public entities

- COVID: an inefficient rollout could cause further economic lockdown’s which would hamper growth

Our thoughts

This was one for the bean counters. A very conservative take on what could’ve been a more aggressive approach to economic reform. Praise must go out to Treasury for resisting the urge to squeeze an already fragile tax base. We have concerns surrounding the alarming debt-to-GDP ratio, and how and when we plan to reduce our debt burden. The fiscal cliff keeps rising. The simplicity of last year’s budget, and again in 2021, may just be the winning formula? However, without meaningful economic reforms and targeted capital spending, we shouldn’t expect a miraculous growth spurt.

Rand reaction

Positive, that’s been the rands reaction to Minister Mboweni’s budget speech, thus far. The local unit has endured a rather volatile start to the week, but found itself breaking below resistance at 14.50/$ moments after Mboweni took to the podium. Trading stronger against both the EUR and GBP as well, the magical Madiba ZAR, is touching its strongest level for 2021.

Article by: Abel Schoeman at Currencies Direct

Source: Sanlam (Click here to download the Sanlam Glasier Tax Guide)