THE IMPORTANCE OF STAYING INVESTED

The economic climate since early 2020 has created insecurity in terms of consistency of investment income, which in turn triggered an urge to panic-sell. History has proven repeatedly that investors who remained firm in their investments during times of hardship, have reaped the rewards in capital growth over the longer term by applying patience and perseverance. In fact, panic selling in turbulent markets locks in perceived losses, and the resultant gains during market recovery are lost as well.

|

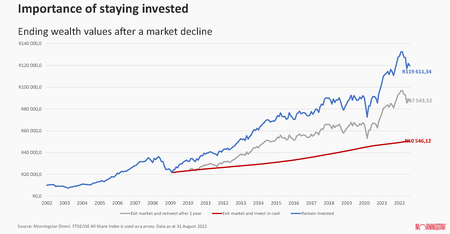

Referencing to the indicators on the chart, it is evident that long term investments equate to capital growth, and more favourable yields. Markets move upwards and downwards constantly and investing for upside gains means contending with the associated risk.

In this example, the investor panicked after the 2008 market crash and sold. The Red line shows the effect of leaving the proceeds in a cash-investment, the grey shows the effect of re-investing in the same funds a year later, and the blue shows the effect of remaining in their investment.

The resulting outcomes are vastly different. While nobody has a crystal ball, time spent in the markets with trusted professionals will yield results in the longer term.

There is no better time than now to examine your financial goals.

Source: Morningstar and Stanlib Standpoint, July 2022