RETIREMENT ANNUITY TAX BENEFITS EXPLAINED

SARS rewards RA investors with a tax refund

Contributions to a retirement annuity/fund are eligible for a tax refund on your annual tax returns. SARS has implemented this "rewards" system on retirement fund contributions to alleviate or prevent state dependency, or reliance on society in retirement years. This is after all the time where you should be reaping the rewards after years of working and enjoying your retirement with a financial peace of mind.

The retirement annuity tax benefit amendment came into effect in 2016 when contributions of up to 27.5% of the total annual income could be allocated to a retirement fund, eligible for receiving a tax refund, or pay less Provisional Tax (capped at R 350 000).

Other Benefits of Retirement Annuities

In addition to the annual tax refund, there are several other benefits that would make a retirement annuity worthwhile:- Increase the tax-free portion: Contributions made to the retirement annuity above the maximum rate, can be carried over to the next tax year. If they are unused over the total contribution period, they can be offset at retirement to increase the tax-free portion of the lump sum paid out at retirement.

- Retirement annuities encourage financial discipline as these savings are inaccessible until the age of 55. Therefore retirement annuities are great products for individuals that may require a strategy to be a disciplined saver and prevent the temptation to delve into or deplete your savings during your working lifetime.

- Retirement annuities also offer financial protection to family members in the event of bankruptcy: Cash benefits from a retirement annuity are not included as part of an estate. Therefore, in the event of insolvency at the time of death of the holder of the retirement annuity, the family members will receive the cash benefit from the retirement annuity, rather than the money going to the deceased’s creditors.

- Retirement annuity investments can enjoy tax-free growth: Investment returns (Interest, dividends, or Capital Gains) are tax free during the period between taking out the annuity and the retirement date.

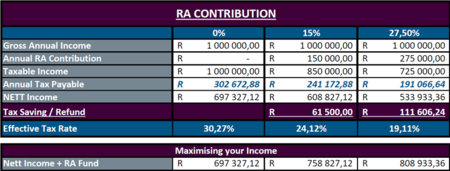

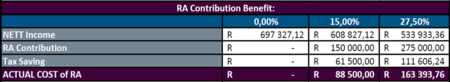

Example of how a RA provides Tax Relief

Herewith a basic example calculated on an income based on the assumption that there are no other expenses. The focus on this calculation is solely on the tax relief offered by saving for retirement, for an individual younger than sixty-five. Individual older than 65 years of age enjoy greater tax rebates.

Freedom of choice in use of tax refunds

There are no restrictions to which the use of tax refunds are applies, however settling any outstanding debt is always a sound advice and a wise decision to make financially.

Another significant use of a tax refund is to invest it in a tax-free savings account, taking into consideration that the annual limit on tax-free account contributions is R36 000 per tax year.

All returns within this investment is free of all Taxes (Interest, Dividends, CGT)

Setting the record straight on perceived negativities associated with retirement annuities

- There are perceived doubts about retirement annuities, where it is thought that the since the individual would receive the benefit of a tax deductions on their annual tax return during the years of employment, SARS would attempt to recoup these funds at retirement- One must remember that the tax bracket during the working years, will be the highest tax bracket, because that is the period where income is the highest. At retirement age, income reduces, and tax rebates are higher after the age of sixty-five. Therefore, there will still be tax on income, but at a significantly reduced rate than the rate at which the deduction was in effect during the years of employment.

- Another misconception is that retirement annuities do not provide decent growth/returns - Even in the unlikely event that the retirement annuity does not offer any returns whatsoever, the tax deduction benefit itself makes it a rewarding investment on its own where the growth on the retirement annuity offers an undeniable dividend.

What can be expected at date of retirement?

In general, the investment funds of a retirement annuity are only accessible at the retirement age of fifty-five and older. The maximum withdrawal amount is up to one third payable in cash. The balance of the investment must then be transferred into another financial vehicle, such as a living annuity or a fixed annuity to secure a source of income during retirement.

Cash lumpsums taken at retirement are taxed according to SARS’s retirement lump sum tax table.

We typically advise clients to only take the first R 700,000 in cash where required to settle debt, and to use the balance to provide a stable income.

Retirement annuity allocations in the event of death

Retirement annuities are exempted from deceased estates; therefore, proceeds are free from estate duties and executors’ fees. The annuity holder can nominate a person(s) as a beneficiary of the death benefit, but the Trustees will determine the allocation between the dependents and the nominees.

Should there be no dependents and no beneficiaries have been nominated, the death benefit will be paid to estate.

In conclusion, retirement annuities remain one of the most rewarding investment vehicles to both build personal wealth and ensure that we maximise the tax benefits available to your advantage, part of sound financial planning.

Source: https://www.sanlamintelligence.co.za/retail/retirement-annuities-is-the-tax-refund-worth-it/